Hi, I'm Jen! I'm a personal finance expert and money coach aiming to help you take control of your money. I went from being broke to a six-figure net worth and am now on track to be financially independent at age 40. Discover Jen's story

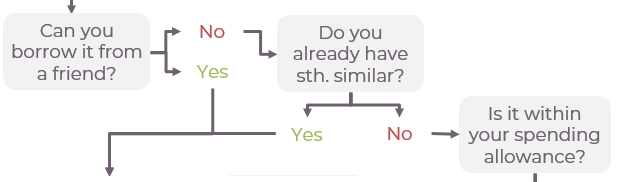

Should I buy it or not? We all have asked this question at least once, or more commonly, ask ourselves regularly. This is why I developed an easy-to-follow flowchart that decides for you.

When to Use the Should I Buy It or Not? Flowchart

The flowchart helps you make purchase decisions for non-consumable items. This includes all household goods you might buy, for example:

- A new television,

- A vacuum cleaner

- A pencil sharpener

Typically, people use the Should I Buy It? flowchart for more expensive purchases. However, you can gain value by consulting the flowchart for any product.

The flowchart won’t help with consumable or perishable goods. This includes groceries and products that wear down, such as toothbrushes.

Should I Buy It or Not? Flowchart

To use the flowchart, start in the left-hand corner and follow the arrows downwards.

Should I Buy It or Not? Decision Map Explanation

Questions 1-3: The Easy Part

The flowchart asks whether you can borrow the item in the first question. You can often borrow items that you don’t use frequently. Borrowing items you use often, such as a TV, is tricky. Unless your friend has a spare TV they do not need, they will likely want it back quickly.

Question 2 asks whether you own a similar item that can fulfil the job. How similar depends on you. For example, handbags have many different designs, yet they all have the same purpose: to carry something.

In terms of carrying ability, you could group similarly sized bags together. In terms of fashion, you could group similar colours together.

Questions 4-9: Within Spending Allowance

This is where it gets more complicated. First, assume the item falls within your spending allowance. Follow the left branch.

Question 4 asks whether you need the item you wish to buy. “Need” means you have an immediate use for the item. You can’t live without it or not having the items makes your life more difficult. Not having the item compromises your survival, regular life, or convenience.

If you do not feel you need the item, proceed to question 5. Ask yourself whether you are buying the item for yourself or somebody else.

Don’t buy the item for yourself if:

- You do not need it and don’t feel good about it or

- It is for someone else but doesn’t have a good cause (question 6)

Assuming you need the item, question 7 asks about your gut feeling or intuition. Do not buy if you feel negative about the purchase. Find out why you feel this way and identify an alternative.

Question 8 looks at urgency and priorities. Prioritise purchases that significantly impact your quality of life over those that are minor. If there is anything you need more urgently, check that you can afford to buy both items (question 9).

Questions 10-11: Not Within Spending Allowance

Here, we go back and look at items that may fall outside your spending allowance. Question 10 asks whether you can make ends meet for the month.

Do not buy the item if you cannot afford food and shelter. Ideally, you should have an emergency fund (or rainy day fund) from which you can take the money.

If you have enough money, proceed to question 11. This question investigates whether the item you wish to buy is essential. “Essential” means necessary to maintain your quality of life.

Question 12: Comparision

Before you buy, the flowchart asks whether the item you wish to buy is the best choice for price and quality. Check price comparison websites for cashback, discounts, and coupons.

Cashback

Cashback means you get a proportion of the purchase price back when you buy something. For example, if you spend £100 and the cashback rate is 2%, you get back £2. You only get this money after you have made the purchase. You can receive cashback from your bank account or dedicated cashback sites. Read more in my TopCashback review.

Quality

Prices also depend on the quality of the product. If the item you wish to buy is one that you use frequently, you may want to opt for higher quality so it lasts longer. If you plan to use the item infrequently, average quality should do.

It is okay to spend money. Moreover, it is necessary to make certain purchases. This includes things you need for physical survival and those that benefit your well-being.

Frequently Asked Questions

Should I Buy Something I Really Want?

If there is something you really want, you should buy it. That is, if you can still pay all your essential expenses and do not endanger your daily life. It is fine not to eat out or to walk instead of taking the bus. Yet, if you cannot afford food or pay bills, you should save before purchasing.

How Can I Afford Things I Need?

Sometimes, you need to buy something even though it does not fit your budget. You must take the money from elsewhere if you do not have an emergency or sinking fund to cover the expense.

Consider whether there is anything you do not need, starting with luxuries. Examples of this include a Netflix subscription, takeaway coffee, or clothes. Next, reduce your grocery costs by cutting down on meat or cooking more simple meals.

Taking out debt should be your last option. Ask your parents or friends for money if you need to buy something. If there is no other option, 0% interest credit cards can help you.

What Do You Consider When Buying a Product?

If you decide to buy a product, consider more than the price and the flowchart. Read product reviews and see how other people liked the product. If it is highly rated, it is likely high quality.

If the ratings are poor, you may want to choose another product. Other than price and reviews, there may be other factors to consider. Depending on the product, this could be:

- Size

- Colour

- Longevity

- Ease of use

- Ease of storage

- Versatility

- Features

- Extras

- Brand

- Warranty

- Quality of the customer support

- And more

Should I Spend Money I Want to Save?

If you ask yourself whether to spend your savings, the answer is “no”. If you want to save money, you probably have a savings goal.

Should I Buy It or Not? Flowchart Limitations

Sometimes, the Should I Buy It? flowchart is unhelpful. The decision to buy something is complicated and depends on many factors.

Additionally, it doesn’t help you with other financial decisions, such as whether to overpay your mortgage. This guide attempts to simplify this complex decision and aid in everyday situations.

This flowchart can save you from impulse buying and unwise decisions, but its success rate also depends on the user. When using it, be honest with yourself.

If you find reducing your spending difficult, consider asking for help. There are dedicated programs to help with shopping addiction.

If you like this post, please help My Money Yard grow by sharing it with your friends.